Berkley Financial Facts

On the City’s Financial Position:

The City of Berkley undergoes an annual financial audit that looks at all facets of the City’s financial operations to ensure that it adheres to a standard called Generally Accepted Accounting Principles (GAAP) set forth by the Governmental Accounting Standards Board (GASB). The results of this audit are clearly stated in a document called the Comprehensive Annual Financial Report, or “CAFR” for short.

Debt

The City of Berkley has very little debt. This is confirmed in the 2017 CAFR summarized in the City’s debt position as follows:

“The City’s debt has decreased significantly over the years with only one governmental activities bond remaining. The outstanding balance on the debt is $1,050,000. The business type activities debt outstanding are all obligations with Oakland County related to improvements with the George W Kuhn Drains.”

(pg iv)

Retiree Healthcare or OPEB Obligations

Even though retiree healthcare has not been offered to new hires since 2008, the City still has long-term obligations to those employees/retirees who previously qualified. Keep in mind that these retirees are more than just names on a page; they are public servants who helped build this community into what it is today. The City made additional investments to increase accumulated assets as its liability continues to shrink. This effort was recognized as a “Financial Highlight” on Page 4 of the audit:

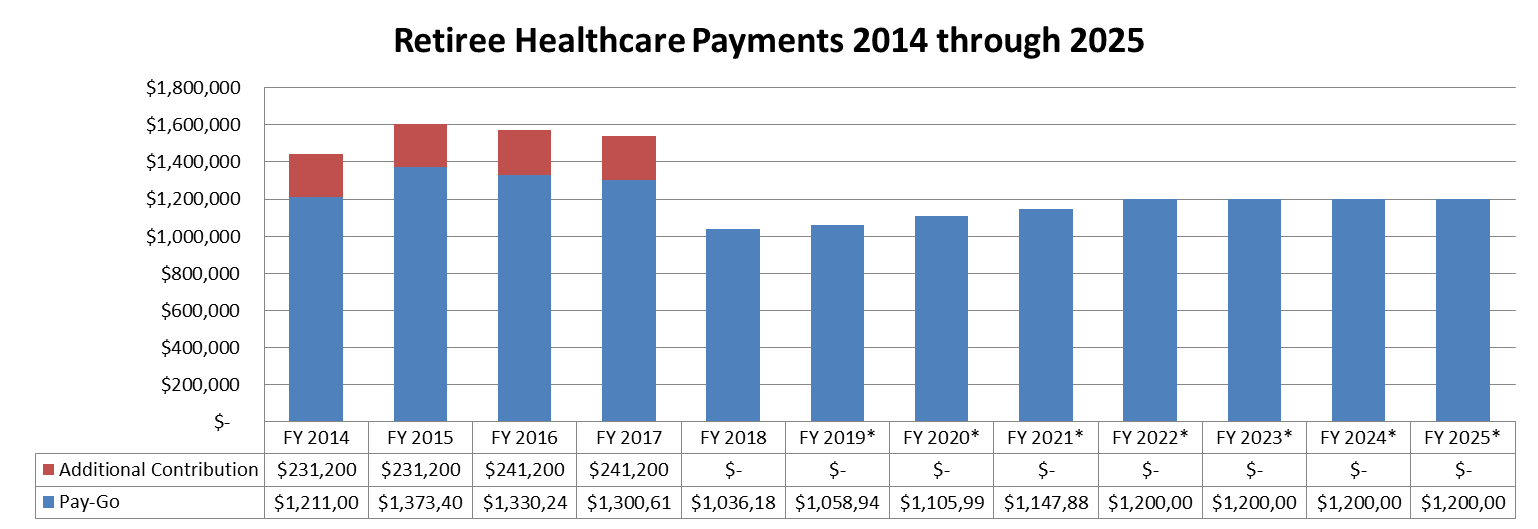

“The City paid $1,300,615 on a pay-as-you-go basis, including an implicit rate subsidy contribution. The City then invested an additional $241,200 toward the OPEB liability in the fiscal year 2016-2017. These additional funds were transferred to the City’s third-party trust for investment and safekeeping. The total payment made by the City in the fiscal year 2016-2017 toward the yearly OPEB liability totaled $1,541,815.”

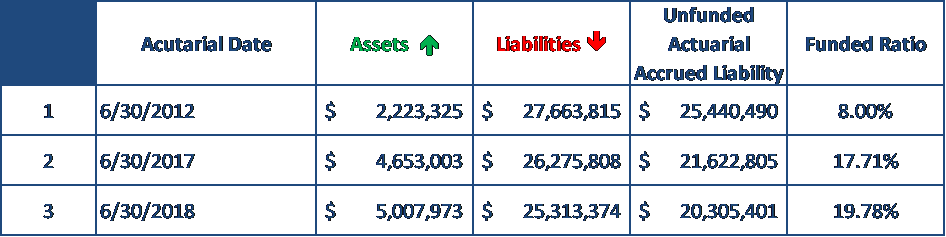

Berkley has a total retiree healthcare obligation of $25,313,374. It is important to note this obligation is spread across several decades but presented as a single number to help budget accordingly. Through strategic investments and additional contributions, the City’s assets continue to grow to meet this obligation, and the funding ratio also has increased. You can see this progress in the chart below:

Because this is a closed benefit, the City is able to utilize a pay-as-you-go funding strategy with contributions. As benefit levels have changed, the annual obligation has also dropped significantly. Whereas the pay-as-you-go payment was $1,300,615 in Fiscal Year 2016-17, the payment dropped by $264,427 in FY 2017-18 to $1,036,188. In 2018, the City worked with an actuary to develop a strategy to reach 40% funded by 2043 and 100% funded in 2052. This proposal would set a limit to the City’s annual obligation to $1.2 million for several years. Here is a comparison of the previous five years compared to the next five years:

Even past the next five years, the City has a year-by-year strategy to grow the OPEB assets all the way through the year 2052 when the obligation is 100% funded. See below:.png)

Pension Obligations

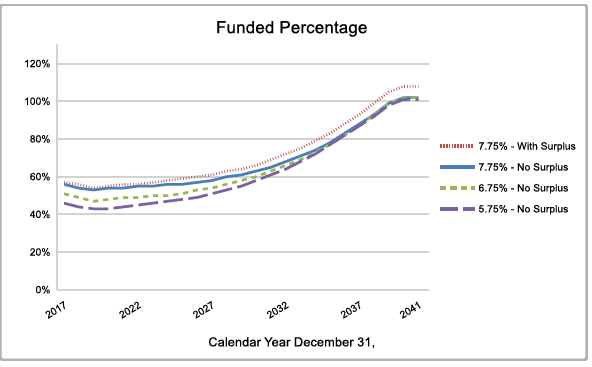

For all non-public safety personnel, the City’s pension plan is administered through the Municipal Employee Retirement System (MERS). The City receives an annual valuation from MERS with a calculation of assets, liabilities, and a funding ratio. Currently, the funding ratio for this plan is 57% and boasts $12,281,293 in assets. Simply put, nearly 60% of the money is available today for bills that will slowly come due over the next three decades. The long-term obligation for this plan is $21,526,662. As with the OPEB obligation, this figure is presented as a single number despite being obligated over the next several decades. Through a combination of strategic investments and City contributions, the pension system is slated to reach 100% funded status in 2040 when the annual costs will drop significantly. MERS, who manages our investments, has consistently yielded a 7.75% return on investment, so for Berkley’s projection see the chart below:

The funding ratio is even more secure for the Public Safety pension. As of 2018, the plan is 80% funded. Again, imagine already having 85% of the next 30 years of your house payment already sitting in the bank.

Berkley’s Credit Rating

Fitch's rating service, which provides credit rating and other financial analysis, confirms the City of Berkley's high-quality rating on general obligation bonds as AA with a stable outlook in January 2017. This rating places Berkley in a solid position as compared to other municipalities in Southeastern Michigan and the State. (2017 CAFR, pg iii)

According to Fitch's rating service, the city has maintained very stable financial operations throughout the most recent economic recession. Management has been proactive in maintaining strong financial resilience given the city's small budget and limited ability to independently increase revenues. Fitch believes that the city will maintain strong financial resilience based on management's history of conservative budgeting practices and solid expenditure flexibility. (2017 CAFR, pg iv)

Related Documents

1. Berkley FY 2018-19 Budget

2. 2017 Comprehensive Annual Financial Report

3. Berkley Financial Facts